how to calculate pre tax benefits

A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover. Calculate how much more money you could take home when you use a pre-tax benefit.

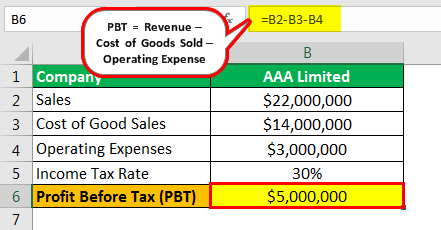

Profit Before Tax Formula Examples How To Calculate Pbt

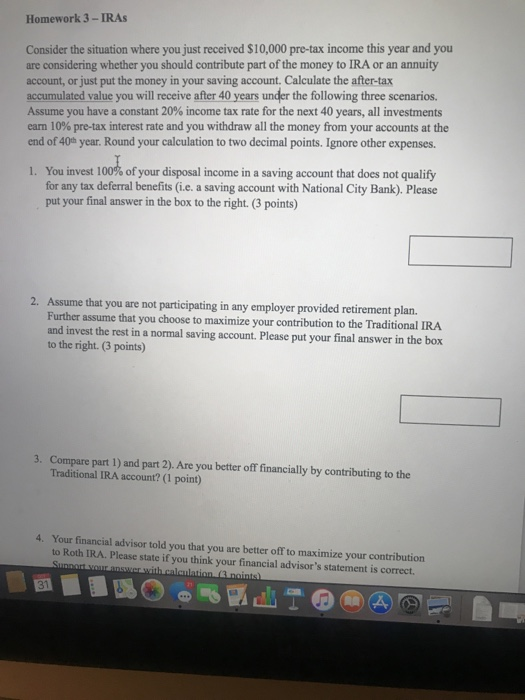

Before taxes you can contribute directly to a 401k from your paycheck.

. A 401k retirement account is a regular benefit of pre-tax income. 501c 3 Corps including colleges universities schools hospitals. 50000 30000 20000.

First indicate if you are insuring. The results provided are an estimate based on the information provided in the input fields. Pre-tax deductions go toward.

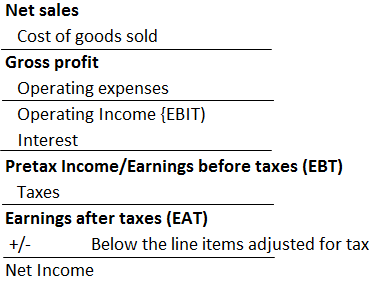

Choose Your Profile profilename Drag Slider to Estimated Tax Rate. You calculate the pre-tax earnings by subtracting operating and interest expenses from your gross profit. Note that other pre.

Generally health insurance plans that an employer deducts from an employees gross pay are pre-tax plans. For example if you made 30000 last year and put 3000 in your retirement plan account on a pre-tax basis your taxable income for the year would have been 27000. Some benefits can be either pre-tax or post-tax such as a pre-tax vs.

Provides insight into a companys financial standing. Actual Cost Of Pre-Tax Contributions. Calculate the employees gross wages.

For example if your biweekly gross. This calculator will show you just how much you are saving in taxes by making contributions to a Health Savings Account HSA. But thats not always the case.

Divide Saras annual salary by the number of times shes paid during the year. HSA Tax Savings Calculator. 403 b Savings Calculator.

Her gross pay for the period is 2000 48000 annual. In short with pre-tax benefits the benefit cost is deducted from an employees paycheck before income and. Actual results may vary.

Pretax earnings hence provide an. Often the type of deduction you need to make is predefined in the policy for the. By offering employees a pre-tax commuter benefit program the cost of commuting deducted for employees reduces the amount of payroll being taxed.

Significance of Pretax Income. And transportation benefits such as parking and transit fees. In this final step deduct the entire.

403 b plans are only available for employees of certain non-profit tax-exempt organizations. Taxes affect the overall earnings of a company. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover taxes.

While shopping for health benefits. Generally speaking pre-tax deductions provide an immediate tax break while post-tax deductions give employees a bigger paycheck. Finance costs include the interest paid by the business on the loans taken from the bank.

A pre-tax deduction is money you remove from an employees wages before you withhold money for taxes lowering their taxable income. But the nuances of pre-tax and post-tax.

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)

Estimating Taxes In Retirement

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Pre Tax Income Vs Income After Tax Your Real Pay Clever Girl Finance

Exploring The Estate Tax Part 1 Journal Of Accountancy

What Is The Child Tax Credit Tax Policy Center

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes And Employer Responsibilities

Pre Tax Vs Roth Contributions What S Best For You Brighton Jones

:max_bytes(150000):strip_icc()/Magi_rev_02-c61224e2abd749928721c438f780e10b.jpg)

Modified Adjusted Gross Income Magi Calculating And Using It

What Are Payroll Deductions Pre Tax Post Tax Deductions Adp

Pre Tax Benefits Explained Through Emojis Bri Benefit Resource

What Are Marriage Penalties And Bonuses Tax Policy Center

Homework 3 Iras Consider The Situation Where You Just Chegg Com

Pretax Income Formula Guide To Calculate Earnings Before Tax Ebt

Calculating Pre Tax Cost Of Equity In Excel Fm

Nopat Formula And Calculator Step By Step